One of the most tumultuous times for media is during election cycles. Whether presidential, midterm or local, elections can affect the entire media ecosystem from inventory to pricing. Equal time laws that impact network/cable TV and radio can mean advertisers lose their preferred time slot or preferred inventory during elections. How can advertisers prepare?

Anticipated Impacts

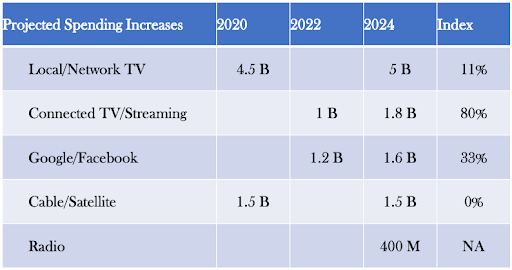

In the last eight years, the U.S. has seen drastic increases in political ad spending. This has been driven not only by more competitive races but also by the additional channels that advertisers are able to invest in. Spend is anticipated to increase across all channels, and political spending in 2024 is already outpacing the record-breaking spend observed in 2020. This election cycle is predicted to be the most expensive of all time totaling $10.2 billion, which represents a 13% increase over the previous record of $9.02 billion set in 2019–2020. The presidential campaign will account for the largest spend at $2.7 billion nationally; however, with over 100 House elections, there is rapid investment in these competitive races.

While all channels will be impacted, some will feel a more significant impact than others. CTV/OTT will see the largest budget increase as this is an emerging channel in terms of viewership, and one that garners attention from younger voters. Across the board traditional media will continue to see large-scale investment and be more dramatically impacted by inventory shortages and inflated costs.

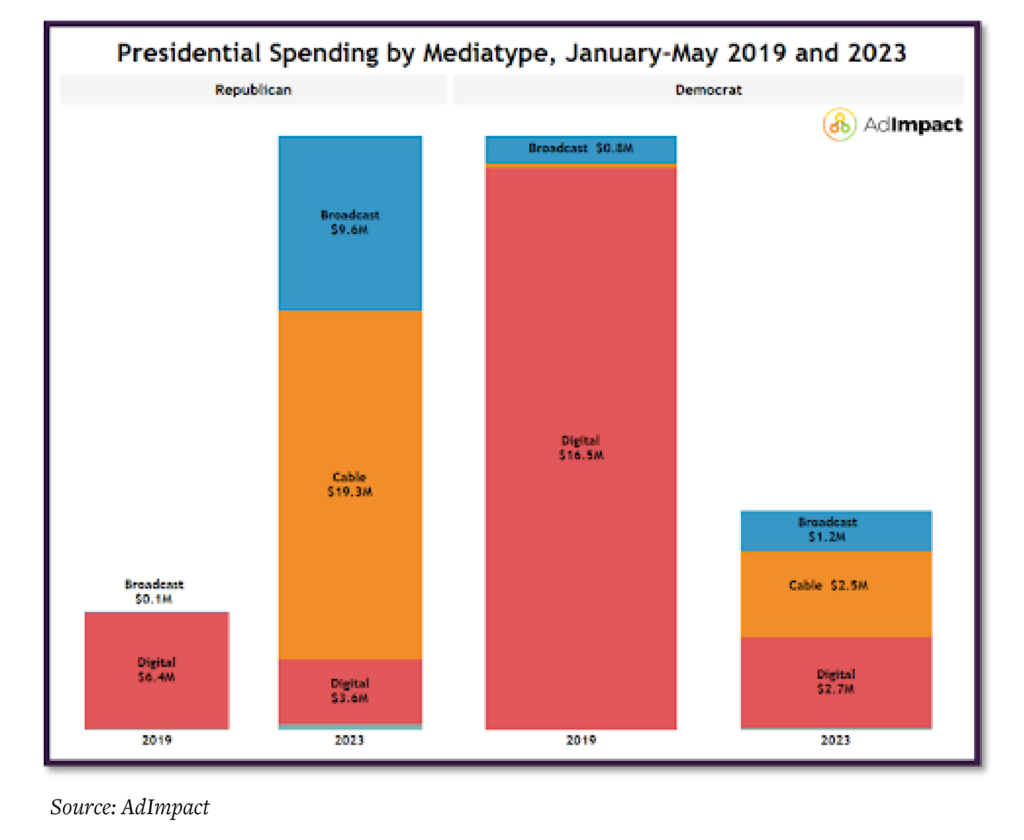

Both parties are more heavily investing in traditional media this year, particularly leaning into cable. This is the most popular media type, with Republicans investing 58% of their spend and Democrats investing 39% of their spend on cable.

State Level Impact

As primaries and elections become more competitive, media in key battleground states will feel the greatest impacts. With a presidential race, 34 Senate races and 100-plus House races, the whole nation will be impacted – but the states that will be the most affected are:

- Arizona (Sen/Pres)

- California (House)

- Florida (Sen/Pres)

- Georgia (Pres)

- Michigan (Sen/Pres)

- Montana (Sen)

- New York (House)

- Nevada (Pres)

- Ohio (Pres)

- Wisconsin (Sen/Pres)

- West Virginia (Sen)

Due to the particularly competitive nature of their races, these states will also experience the highest ad spend:

- CA: $1.19 billion

- AZ: $821 million

- PA: $725 million

- NV: $576 million

- MI: $659 million

- NY: $437 million

How Advertisers Can Minimize Impact

There is no simple answer, and there will likely be an impact to your media plans, whether it is preempted inventory or inflated CPMs. However, there are ways to minimize the impact:

- Plan ahead. Start looking now at when it is critical for your brand to be in-market and how that time period overlaps with periods of high political spend. Seek opportunities to front- or back-load spend before or after the election.

- Don’t go dark. Consumers will be overwhelmed by political messaging and will seek refuge from a brand offering an escape. Continue to be a resource for consumers in an overwhelming and stressful time.

- Evolve media mix. Ensure your media mix includes channels that are not impacted by equal time laws as well as those that have access to deeper inventory pools like digital display, CTV and paid social.

- Ensure brand safety. Politics can bring out the worst in people and in the news cycle; ensure your messaging is still being delivered in a brand safe environment.

- Refine markets. Understand what markets will be the most competitive and seek reduced investments or alternative markets when possible.

- Focus your targeting. In order to minimize competition with political advertisers, target only your specific audience and avoid being too broad by relying on strictly demographic or geographic targeting. Lean into intent and first-party data.