Earlier this spring, MMGY launched its inaugural Destination Marketing Technology Survey designed to learn from tourism marketing leaders about their use and perception of marketing technologies such as websites, email marketing and emerging technologies.

The goal of the survey was to gain and share valuable insights from destination marketing professionals related to technology usage and adoption and gauge their perceptions of technology’s role in the future of destination marketing. Sent out to nearly 70 destination marketers, the survey represented a statistically significant sample size of the industry, with participants representing multiple cities, regions, states and countries. Participating DMOs reported annual marketing budgets ranging from less than $500,000 to over $10 million and annual website marketing budgets ranging from less than $100,000 to $500,000 or more.

Because of the breadth of topics, the survey was split into three quarterly components. Below you will find a few of the key findings from the website marketing component. We will be sharing the results of the email marketing and emerging technologies portions in the coming months.

KEY FINDINGS

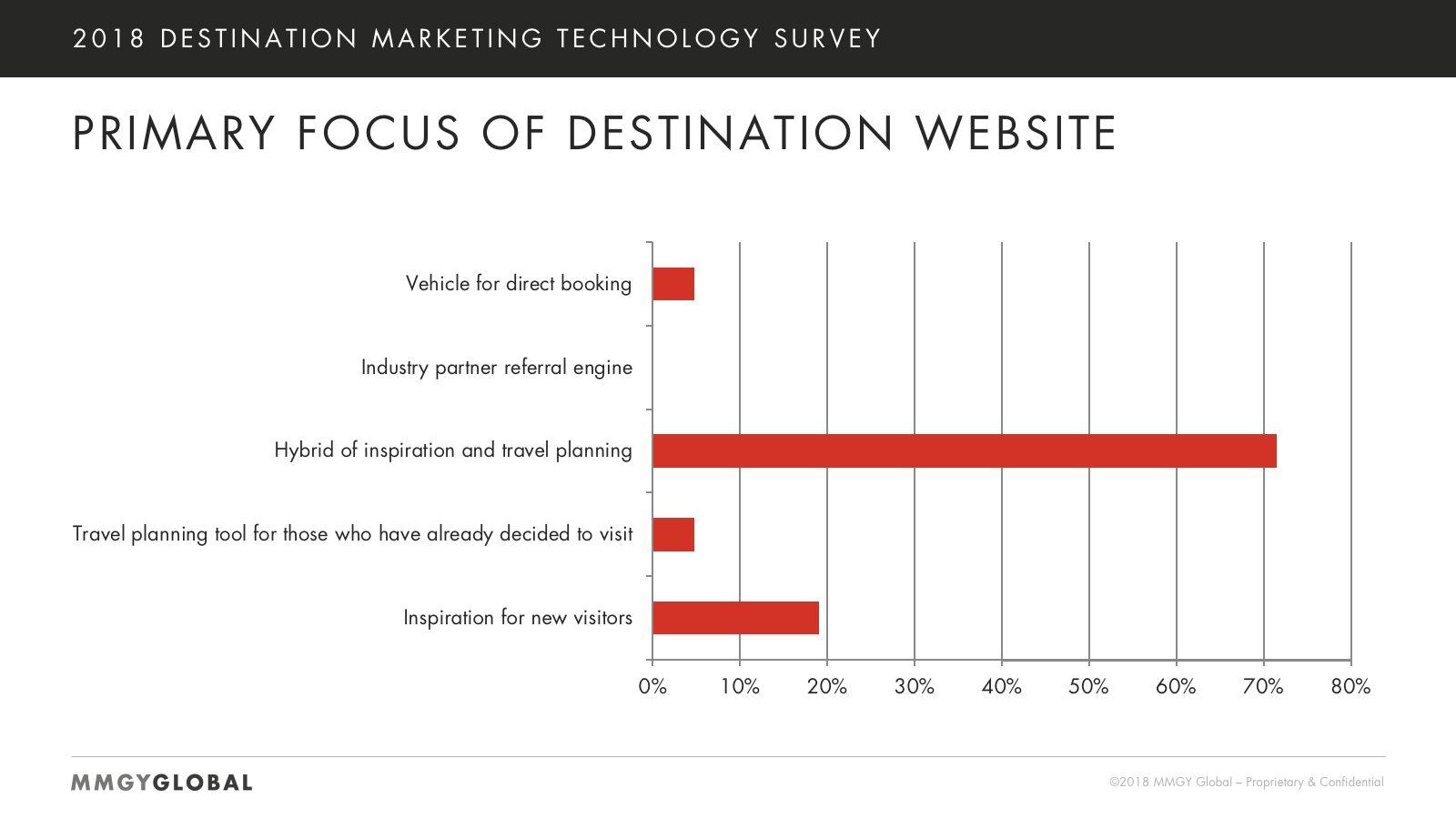

Destinations are seeking to balance inspiration and travel planning, with 72 percent of destination marketing respondents stating the primary purpose of their website is to have a hybrid of inspiration and travel planning. This poses a new challenge and opportunity for destinations to identify at what point travelers are in the travel planning process and ensure they are providing the content and solutions travelers are looking for based on where they are in the consumer journey.

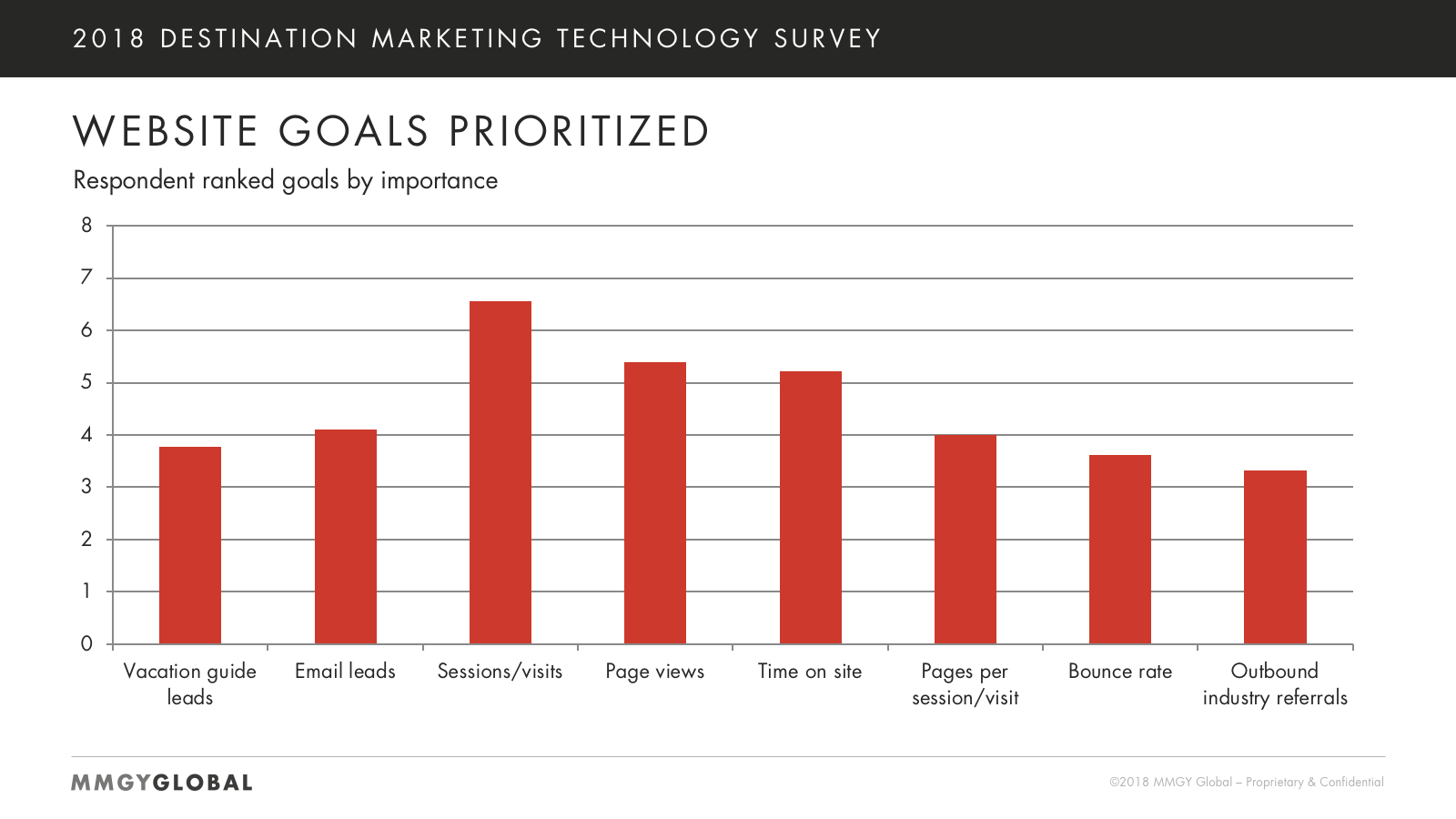

The primary key performance indicators for website performance continue to focus on brand impressions in the form of sessions and page views. Engagement metrics such as time on the site and pages per session were also strong areas of focus. Interestingly, destination marketing executives placed the least importance on outbound industry referrals.

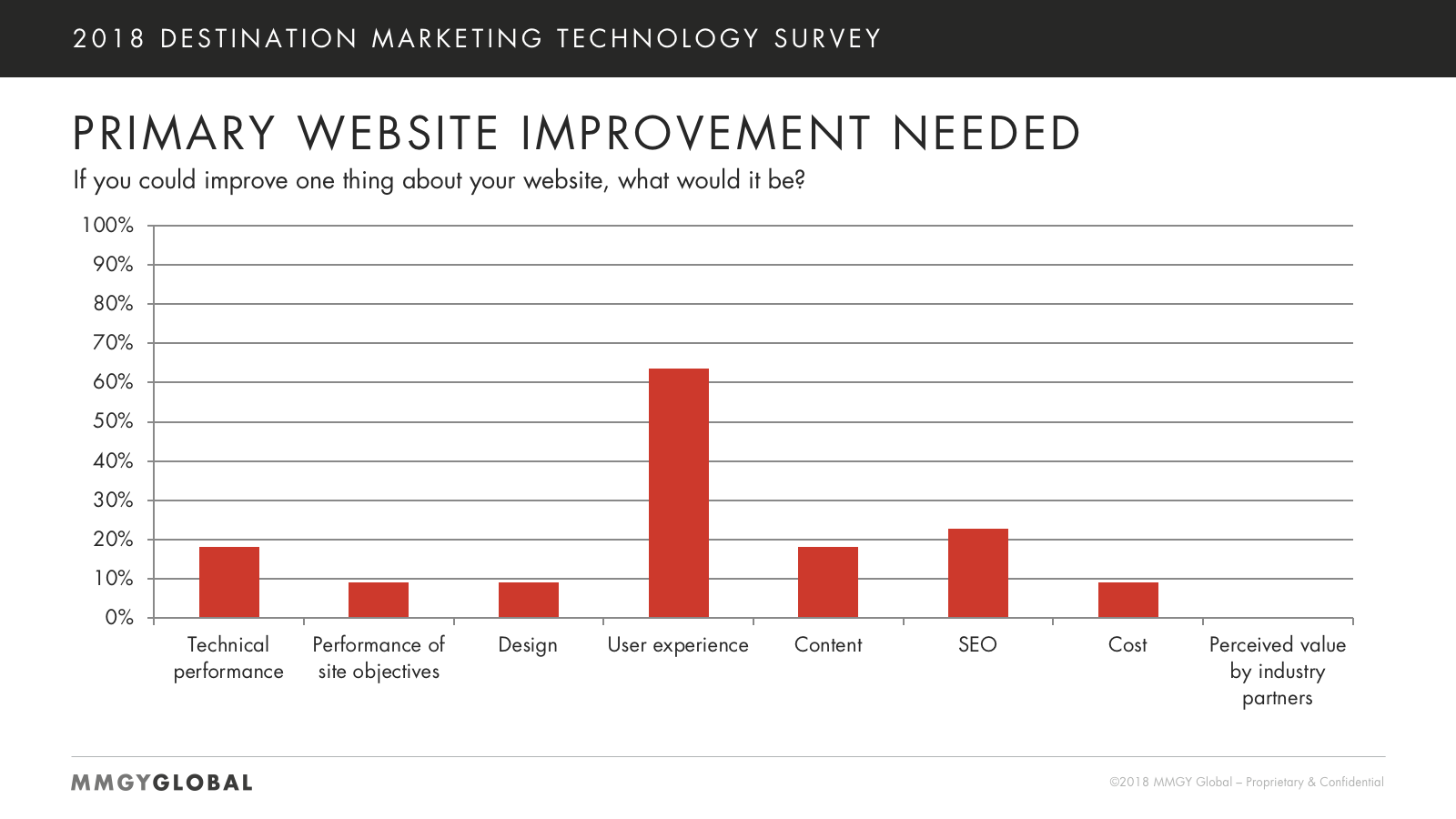

Sixty-four percent of destination marketers named “user experience” as one thing about their website they wished they could improve. At 40 points higher than any other area of improvement listed, it appears that destinations are struggling with how to effectively produce a website experience that provides both inspiration and travel planning.

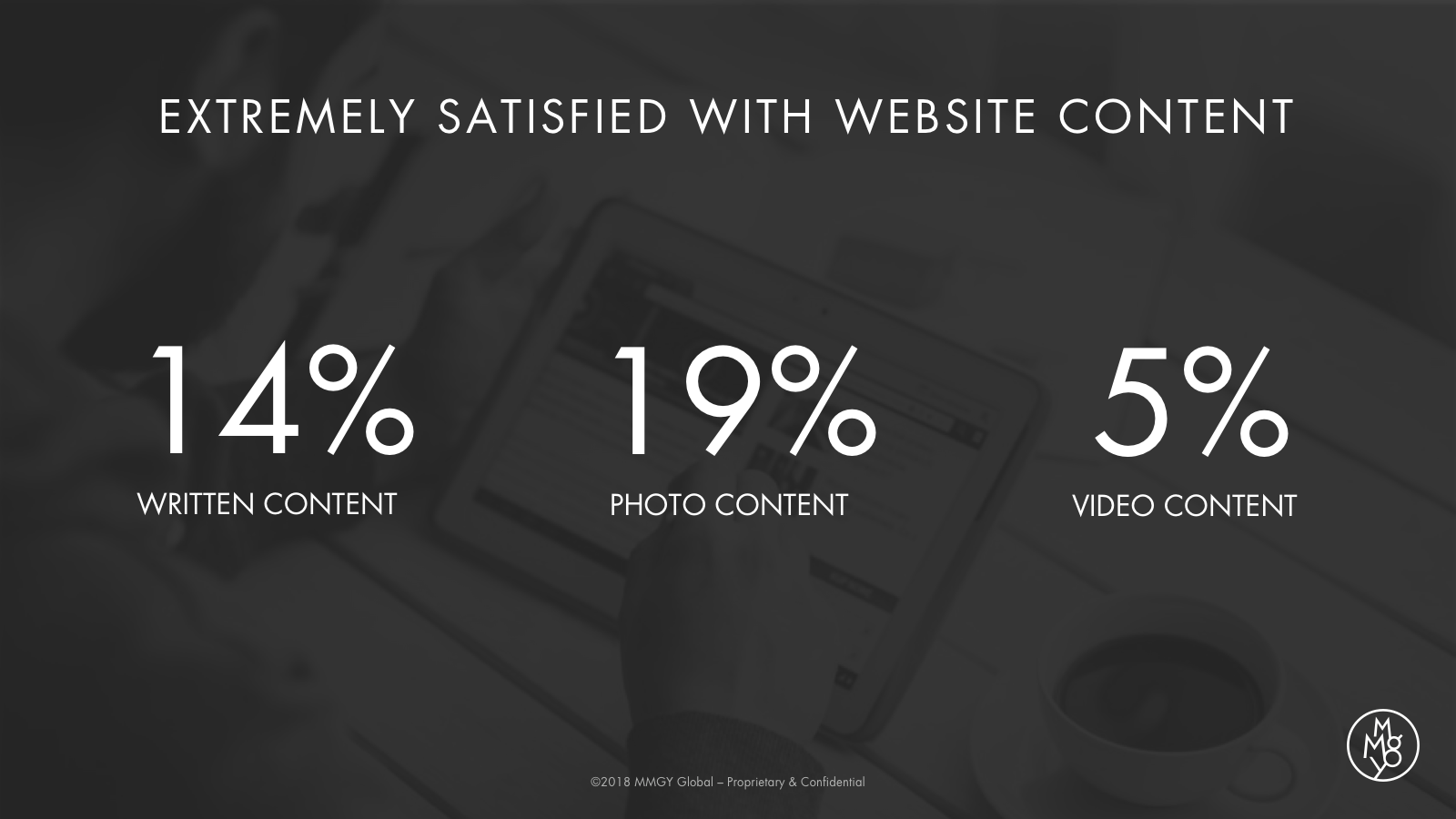

Destination marketers are most satisfied with their photo content and least satisfied with their video content. When ranking content satisfaction from extremely satisfied to not at all satisfied, the majority of marketers were extremely or somewhat satisfied with written and photographic content, while half of respondents said they were neutral or not satisfied with their destination’s video content. Eighty-four percent of those surveyed stated they are currently incorporating user-generated photos into their websites, which may be aiding the perception of satisfaction in photographic content.

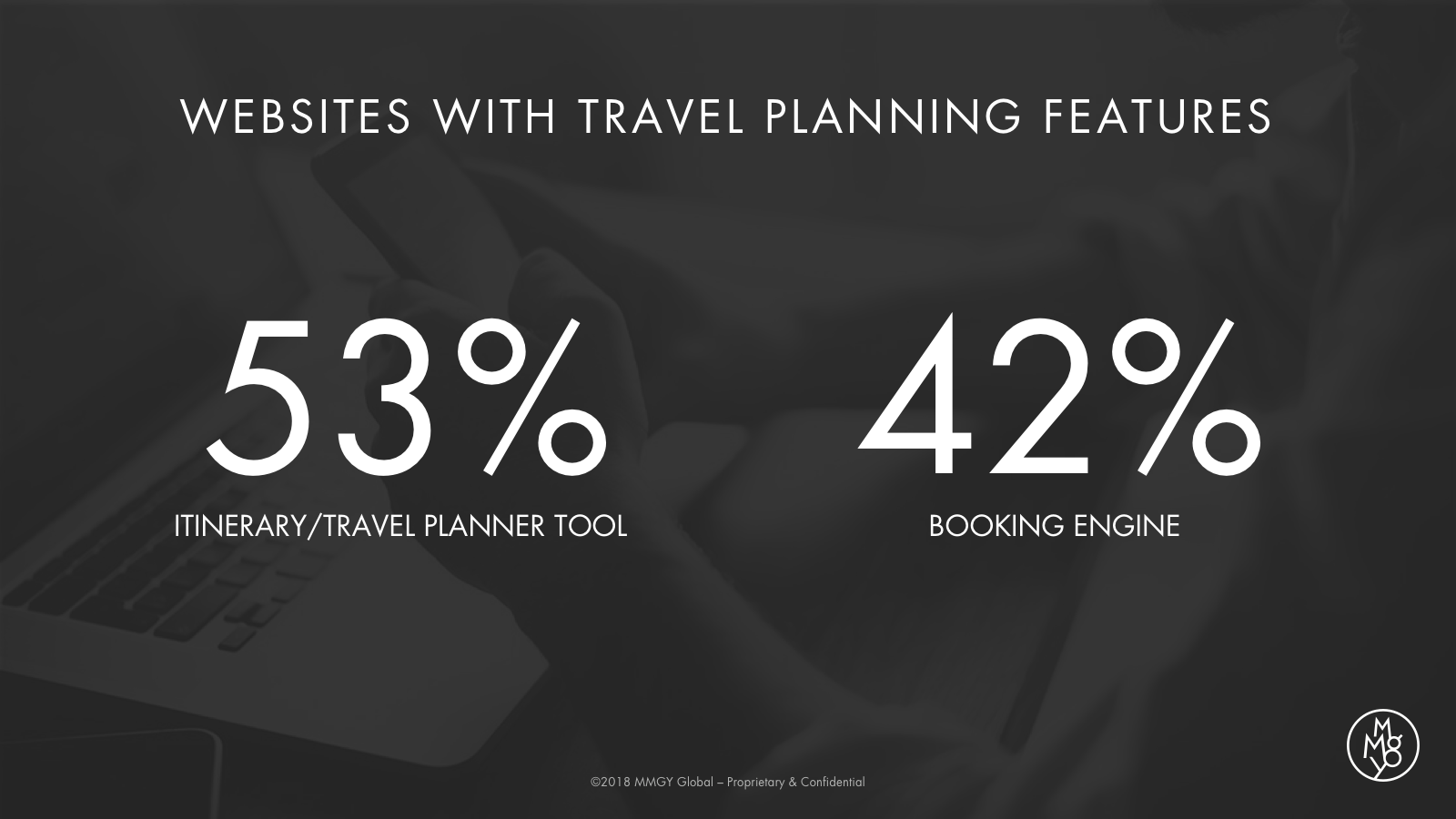

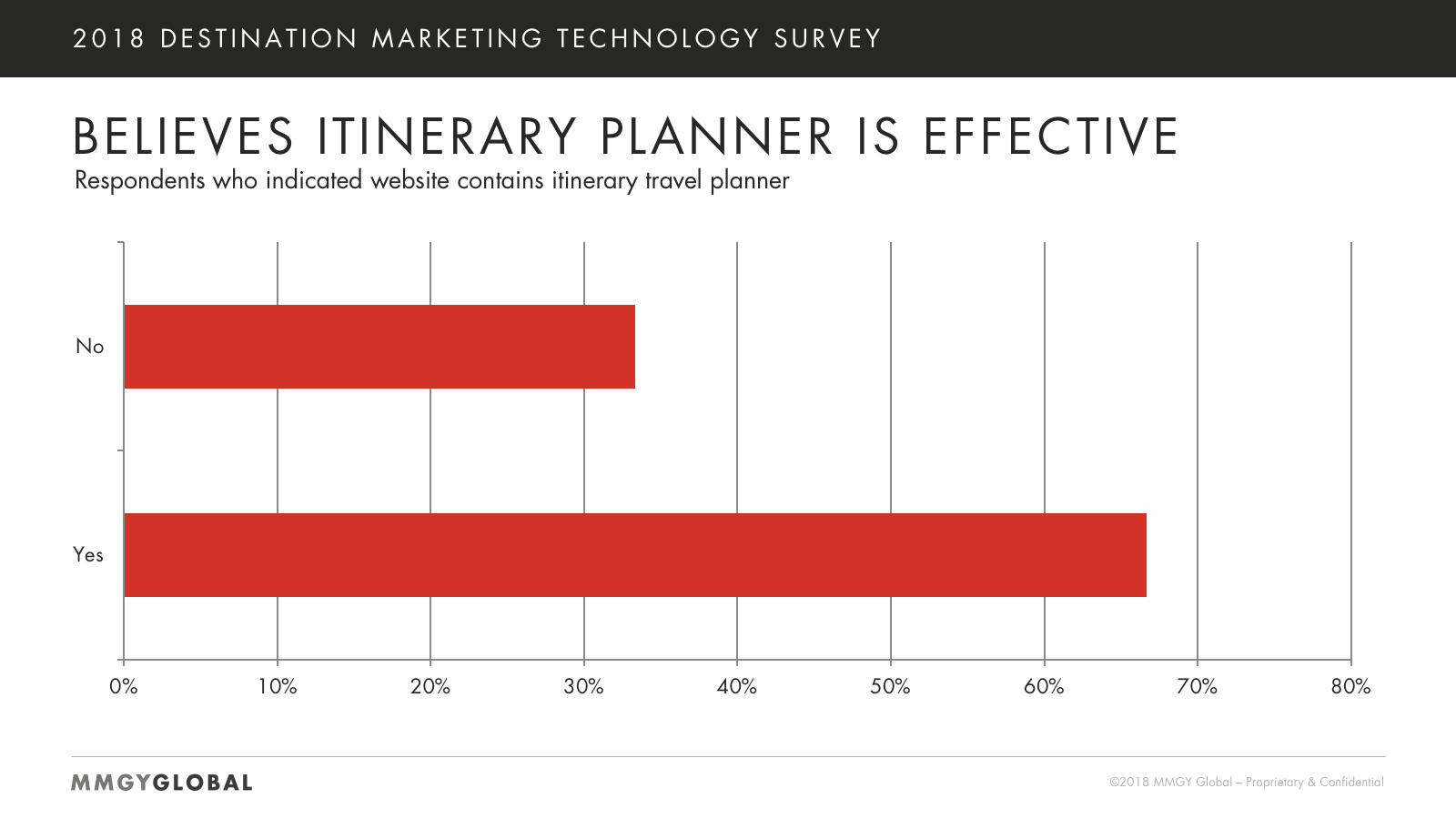

Over half of respondents report having itinerary or travel planner tools on their destination’s website, with 67 percent of those destination marketers believing these tools are effective. This finding contradicts MMGY Global’s analytic-driven industry benchmarking of DMO itinerary or travel planner tools. In our own analysis, we found only 1 percent of users engage with and utilize these tools, which can represent a significant website capabilities investment.

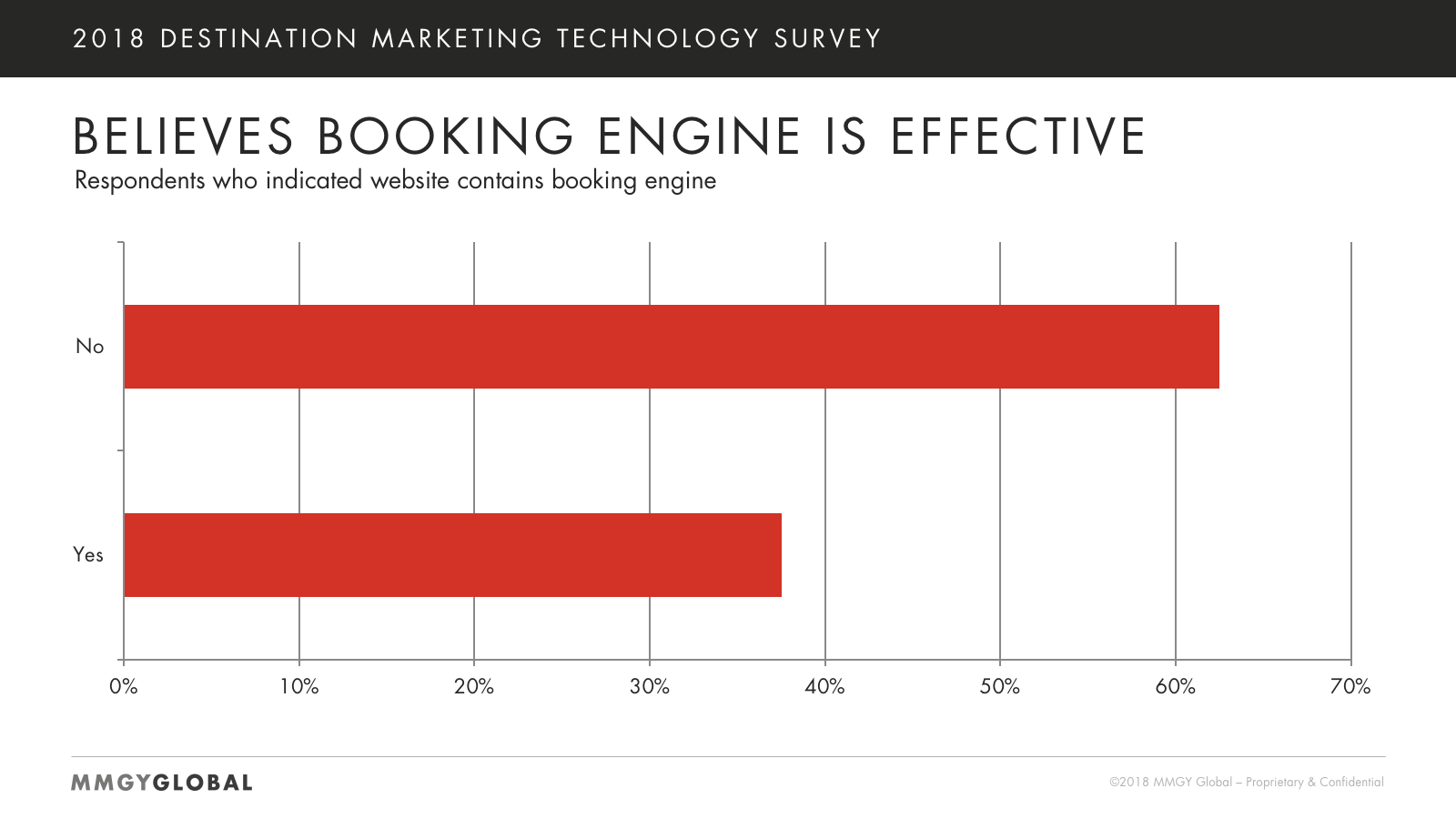

Forty-two percent of survey participants indicated that their destination’s website contains a booking engine, with 63 percent of those respondents stating that they do not believe the booking engine is effective. Of the 58 percent of DMOs whose websites do not contain a booking engine, 91 percent stated that they are not planning on adding a booking engine to their website in the next 12 months. These data points validate earlier findings that DMOs are less interested in positioning themselves in the transactional phase of travel planning.

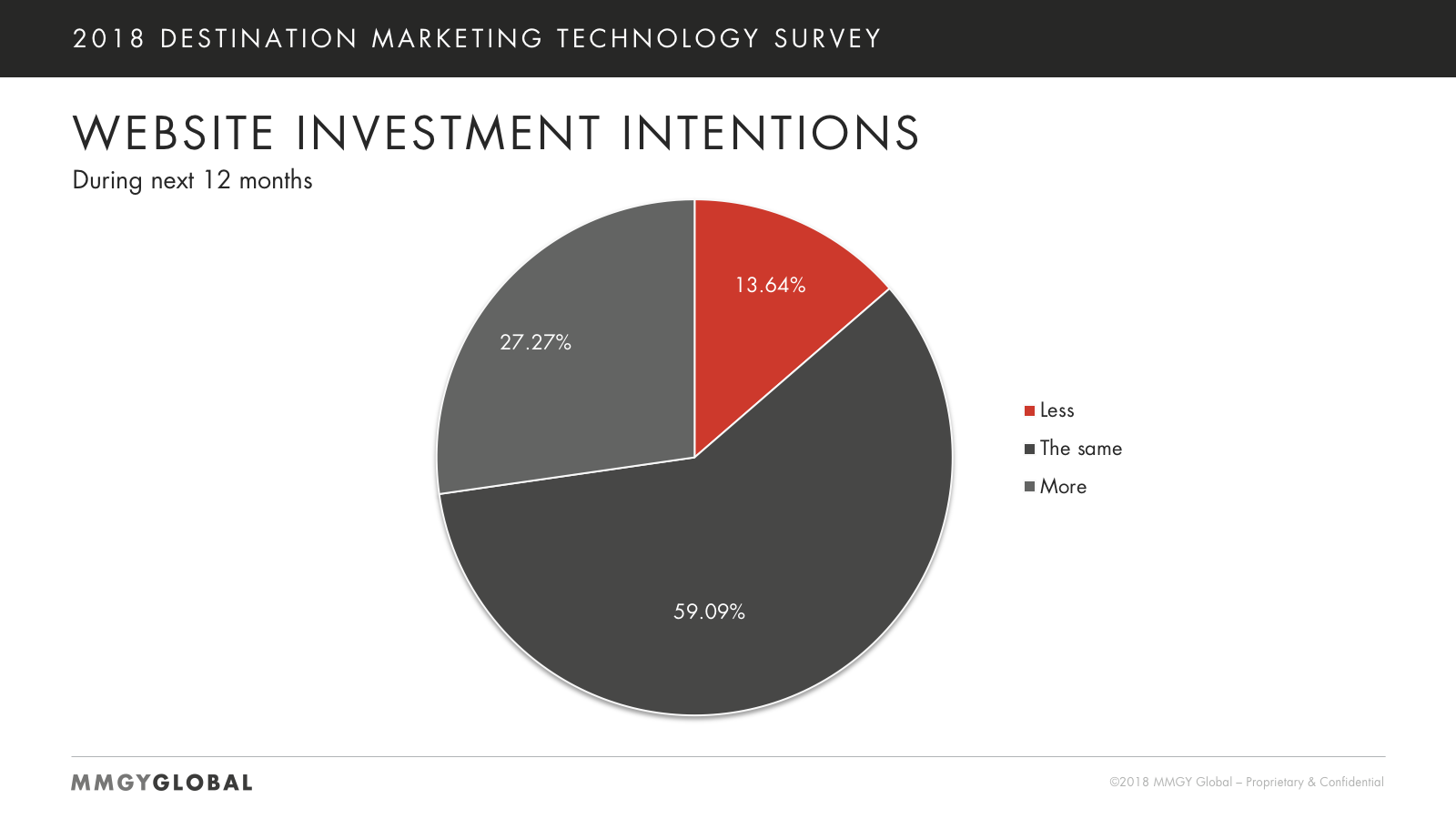

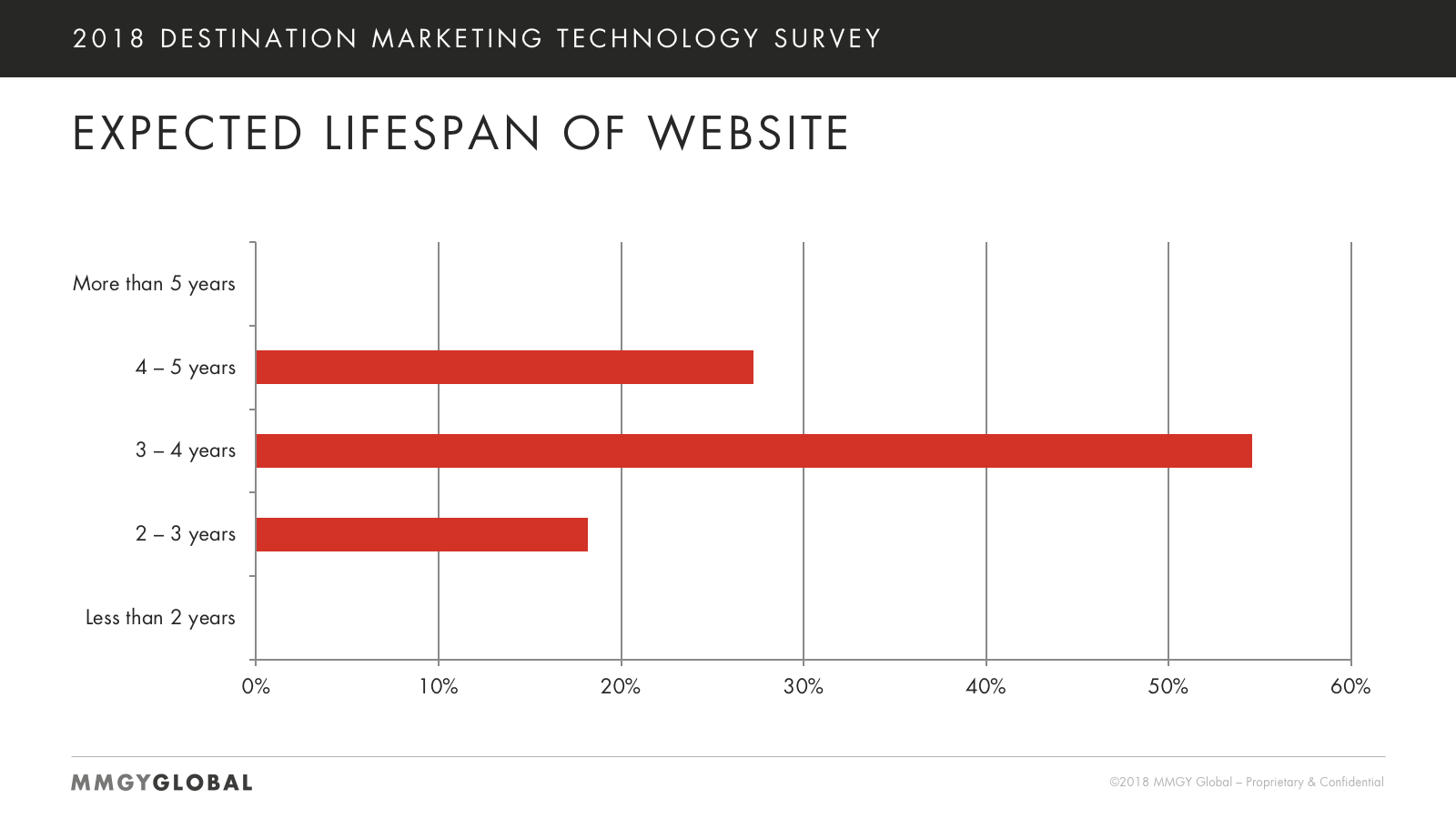

As investments in destination marketing continue to be fragmented, survey respondents have indicated that they are not planning on decreasing investments in destination websites. However, it appears that destination marketers are expecting their investment in websites to last longer.

If you are a destination marketing executive and would like to participate in future destination marketing technology surveys and receive the full 2018 Destination Marketing Technology Survey on website marketing, please contact Robert Patterson at [email protected].